I Rent, So Why Do I Need Insurance?

I Rent, So Why Do I Need Insurance?

Millennials are now the largest segment of our population. They soon will be the largest percentage of our workforce. The “everyone gets a trophy” generation has gotten some bad press, but they are social, socially responsible and tech-savvy. They also don’t like paying for more than they use. This has led to the popularity in ride-sharing, use of rental bikes and scooters and a slower trend toward homeownership. There’s nothing wrong with this philosophy and some view it as a way to minimize obligations and expenses. This can lead to the mistaken notion that if one rents a home or apartment, they don’t need to have insurance.

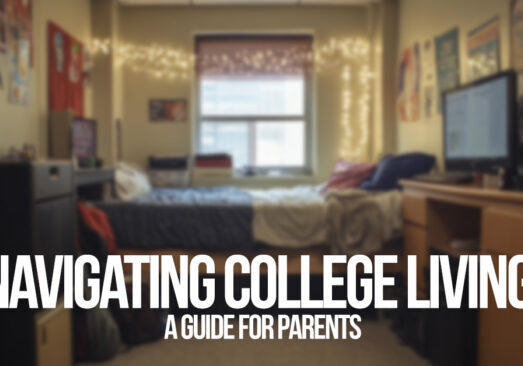

The fact is that the landlord or property owner may have coverage on the rented structure, but that coverage will likely not cover the tenant’s contents and belongings. Furthermore, it doesn’t relieve the tenant’s responsibility for any injuries that may occur in their home or apartment. The solution? Renters insurance.

What is Renters Insurance?

Renters insurance is a policy that covers those who choose to rent the space they live in. There are three significant ways renters insurance protects tenants.

- Personal Property Coverage – Renters insurance will cover the personal property of a tenant due to theft or a natural disaster. These losses can be quite significant when one considers their furniture, clothing, collectibles and expensive electronic devices. Imagine losing your tablet, laptop or smartphone. Have we got your attention?

- Liability Coverage – If a pizza delivery person falls while in your apartment there could be more damage than the loss of a pizza. Even an injury to a friend or relative in your rented home can lead to a liability claim. The liability coverage of a renter’s policy protects you from the financial losses associated with a liability claim including legal and settlement costs.

- Protection While Traveling – One of the overlooked benefits of renters insurance is the coverage it provides for your belongings while traveling. Should possessions (like that tablet) get stolen while traveling, your renter’s insurance will likely cover it, based on any deductible.

It is Affordable

Millennials and everyone else for that matter will appreciate how affordable renters insurance can be. It can generally be acquired for just a few dollars a week.

Just because you rent your home doesn’t mean you don’t need insurance. The good news is, it is a much cheaper option. Contact us to find out how renters insurance can provide you just a bit more peace of mind.

Insure Your Future....

Contact Us

OUR LOCATION

8442 Federal Blvd Westminster, Colorado 80031-3818

303-427-9600

© Copyright 2024 DIAZ AGENCY INC | All Rights Reserved

Site by ICA Agency Alliance

8442 Federal Blvd Westminster, Colorado 80031-3818

303-427-9600

© Copyright 2024 DIAZ AGENCY INC | All Rights Reserved

Site by ICA Agency Alliance